In the last couple weeks I have read a lot about gas prices and the threat by Jason Kenney to shut down the Trans Mountain pipeline. Since a lot of what I have read is incomplete and/or incorrect, I figure it is time to prepare a quick primer to help understands the refined fuel market in BC and what Jason Kenney may, legally, be able to do to mess that market up.

Understanding the BC Refined Fuel Market

Let’s start with what we know about the BC refined fuel market. Let’s start with this from an article in Business in Vancouver:

Provincially, B.C. lacks refining capacity. B.C.’s two refineries produce only 67,000 barrels per day (bpd) of gasoline and diesel, whereas B.C. consumed 192,000 bpd in 2015, according to the CFA [Canadian Fuels Association]. The Parkland Fuel Corp. refinery in Burnaby produces 55,000 bpd and supplies about 25% to 30% of Vancouver International Airport’s jet fuel supply. Alberta’s refineries supply about 100,000 bpd to B.C., and about 30,000 bpd is imported from Washington state refineries, according to the CFA.

To our south, the United States has broken their petroleum market up into five Petroleum Administration of Defense Districts (PADDs). The West Coast of the US, including California, Oregon and Washington, make up PADD 5. Geography defines PADD 5. It is mostly bordered on the east by mountains. The only (non-rail) major east-west connection on the west coast is the Trans Mountain pipeline. As the US Energy Information Administration (EIA) puts it:

Because PADD 5 is isolated, in-region refineries are the primary source of transportation fuels for PADD 5. In 2013, PADD 5 refinery production was sufficient to cover about 91% of in-region motor gasoline demand, 96% of jet demand, and 113% of distillate demand. Heavy reliance on in-region production further complicates the supply chain when disruptions occur. When disruptions occur, all of these factors noted above combine to limit short-term supply options, lengthen the duration of supply disruptions, and cause prices to increase and remain higher for a longer period than would be typical in markets outside PADD 5.

In a nutshell, BC is short 30,000 bpd in refined fuel supply domestically and relies on Washington State refineries which sell into a PADD 5 market that is also significantly short on supply.

Even more problematically, most of the big refineries are owned by oil companies that have long-term contracts for most of their production. We can only buy our 30,000 bpd out of the left-overs and we are competing with Oregon and California (that are also under-supplied) for whatever the Washington refineries have to sell. What is worse is that at this time of year the refineries have to temporarily lower capacity to allow the transition from winter gasoline to summer gasoline. The reason for this is that gasoline is affected by temperature and the winter blends have more volatile components needed to help cars run in the cold.

As for the suggestion that the Parkland refinery can somehow fill in the gap. The truth is that, as a very small refinery, Parkland has needed to specialize to survive in the international market. Parkland has specialized by tuning their refinery to make jet fuel and the more expensive high-octane, premium fuels. It actually exports some of this premium gas in the US market. To make regular gasoline, in any reasonable quantities, would require the refinery to shut down and would take time and money.

The only other significant facility in the Lower Mainland is the Suncor Burrard Products terminal. As I will point out below, the Trans Mountain is a batched pipeline. It carries refined fuels, light crude and heavy crude. One issue with batching is the refined fuels can pick up impurities left over from the heavy oil on the way. Before gasoline can be sold on the market it has to go to the Suncor facility for clean-up.

To conclude, the take-away from this section is that BC has an ongoing shortage of about 30,000 bpd in refined fuel supply, with no large marine import facilities. We are buyers in a seller’s market (PADD 5) and have no ability to change that equation. Should we choose not to buy the fuel from the Washington refineries, they have lots of other options. So we are price takers not price makers.

Local Gas Prices

The next topic to discuss is our local gasoline prices. Our local gas price has a lot of factors built into it. Let’s start with taxes. Provincially, in the lower mainland we pay 34.39 cents/L (c/L) of provincial taxes for every liter of gas. This can be broken down to:

- 17 c/L in TransLink Tax,

- 6.75 c/L in British Columbia Transportation Financing Authority Tax

- 1.75 c/L in Provincial Motor Fuel Tax, and

- 8.89 c/L in Carbon tax

The federal government also gets its pound of flesh. Federally we pay:

- 10 c/L federal excise tax and

- 5% GST on our total purchase price (or 7.5 c/L on $1.55 gas)

Adding up all the taxes together we get 51.89 c/L for taxes on $1.55 gas. Now the problem with the gas business is that it is very opaque. The internal prices are kept private but one thing we are privy to is the rack price. The rack price is defined as:

the cost of the gas itself, as well as transportation, overhead, and profit costs. The price can vary from terminal to terminal and depends on the cost of crude oil and related refining costs. The rack price also depends upon the distance between the fuel retailer and wholesale terminal. A gas station located far from a terminal is going to pay a higher fuel rack price than one located just down the street.

That would be all the costs, exclusive of the dealer’s mark-up which pays for the retail facility and all its staff. Most oil companies publish their rack price somewhere. Here is a link to the Petro-Canada daily rack price for Canadian cities. In Edmonton, on April 14, 2019 it was 83.30 c/L while in Vancouver it was 105.2 c/L. There is a 21.9 c/L difference in the rack rate. This difference is the scarcity premium we pay because it is expensive to send gas to the west coast, then clean up the gas at the Suncor facility and then sell it to the big distributors. The only way to decrease that scarcity premium is by eliminating scarcity.

Assuming the rack price is pretty comparable between retailers (to simplify this discussion) then all we need to add is the dealer’s mark-up. This is normally around 12 c/L. So our gas ends up with:

- $1.052 rack price

- $0.3339 provincial taxes

- $0.10 federal excise tax

- $0.075 GST

- $0.12 dealer’s mark-up

This becomes a gas price of $1.68/L.

Green fuel requirements

One thing we seldom hear discussed represents another big challenge with importing gasoline to BC: our fuel regulations. The Greenhouse Gas Reduction (Renewable & Low Carbon Fuel Requirements) Act and the Renewable & Low Carbon Fuel Requirements Regulation define what our gasoline looks like. Part 2 of the Act establishes the renewable fuel content requirements for gasoline and diesel sold in British Columbia:

- Fuel suppliers must ensure that they have a minimum renewable fuel content of five percent (5%) for gasoline and four percent (4%) for diesel, on a provincial annual average basis.

- Fuel suppliers have the flexibility to vary their blend percentages and can choose where in the province they supply renewable fuel blends, as long as they meet the provincial annual average requirement for renewable fuel content.

What does this mean for consumers? Well it means we can’t simply buy gas from Asia or California and sell it off the boat to retailers. Instead gasoline from other suppliers would need to be imported and mixed with enough ethanol to meet the BC regulations before it can be sold. This is another way we have, through our desire to fight climate change, made it harder (and more expensive) to get gas in BC.

Trans Mountain Capacity and allocations

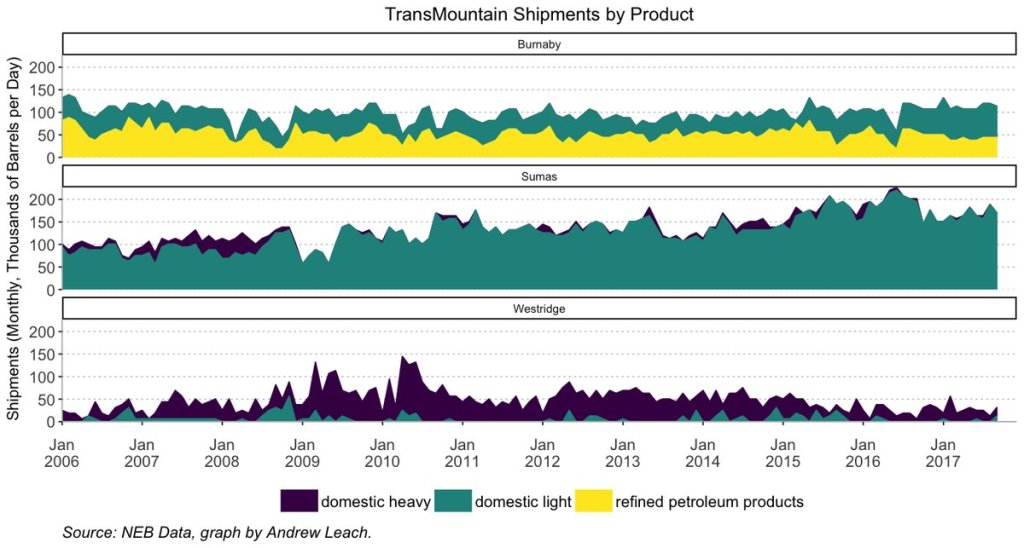

Going back to the Trans Mountain Pipeline, we are all told that the Trans Mountain has a nominal capacity of 300,000 bpd. But that is not the entire story. You see the Trans Mountain is a batched pipeline. It carries refined fuels, light crude and heavy crude and the relative amount of each defines the actual capacity of the pipeline. Here is how those volumes have looked over the last few years.

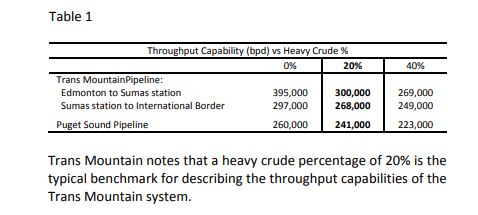

The thing to understand about the pipeline is that the 300,000 bpd assumes we are moving 20% heavy crude. As the table below shows, the actual capacity of the pipeline would change dramatically if we changed the mix running down the line. The Trans Mountain can carry 395,000 bpd of light/refined, or 300,000 bpd if 20% is heavy or 269,000 bpd if 40% is heavy.

This means that if we can get all of the heavy fuel out of the pipeline (say moving by rail via CanaPux) then that would be almost like getting a brand new pipeline. Running only light crude and refined fuels, the pipeline could supply the Puget Sound with 260,000 bpd while still leaving lots of room for Parkland and the West Coast market. The flip side of this equation is that if Alberta were to require that the pipeline carry 30% – 40% heavy it would push the capacity of the pipeline down to 269,000 bpd which could squeeze the amount of refined fuel running down the pipe.

One additional fact that is not well known is that in 2010 the NEB provided the Westridge marine facility with two allocations. A firm allocation of 54,000 bpd and and uncommitted allocation of 24,000 bpd. As you can see from the graph above, over the last few years the marine terminal has been getting the short end of the stick but that doesn’t have to be the case. Essentially, the NEB said that the suppliers can demand up to 79,000 bpd be sent to the marine terminal. 79,000 bpd represents almost 30% of the pipeline capacity if that 79,000 bpd were heavy crude.

Now this is where it becomes interesting. Given the NEB’s decision, it is possible that Alberta could require that the entire marine allocation be put in the pipe as heavy fuel (say by nominating a whole lot of the in-kind bitumen they get in lieu of royalties). If that were the case it would, as discussed above, put the squeeze on the pipeline and reduce the amount of refined fuel running to BC. This would represent an entirely legal way that an Alberta government could constrain BC fuel supplies and there would be nothing a court could do about it. Simply enforcing existing allocations using heavy could shrink the amount of anything else running down the line.

Conclusion

To conclude we, in the Lower Mainland, are buyers in a sellers market. We have no ability to dictate to the market and if the provincial government decided to regulate gasoline it would have to start high because Canadian governments can’t force American refiners to sell them gasoline.

The Lower Mainland also lacks marine facilities to significantly increase the amount of fuel that comes here by ship and BC gasoline regulations would require that any imported gasoline be adapted to meet our local requirements. Both would raise the price of gasoline even more.

If Alberta wants to squeeze BC it can shut down the pipe. But if it did the courts would deal with that in hours/days. But the truth of the matter is that Alberta is full of smart people and they know that the Trans Mountain can be gamed to reduce the amount of refined gasoline coming down the pipe. This will have price consequences.

I’m going to end with the environmentally interesting part of this story. If you were an environmentalist wanting to reduce BC’s carbon emissions and our dependence on fossil fuels you should be cheering Jason Kenney on. Thanks to the Law of Unintended Consequences any effect he has on prices will force people to find alternatives. The reason we have carbon taxes is to increase the price of carbon-intensive fuels to discourage their use and encourage users to seek alternatives be they EVs, transit, walking or avoided trips. The reality of the case is that if they are looking to fight climate change, Jason Kenney and high gas prices are something they should be aiming for, not fighting.

Thank you. A very well written piece that explains the complexities of the fuel market in BC.

LikeLike

Blair, thanks for this. I forwarded the link to this analysis to Don Braid at the Calgary Herald. Much of the media looks at this as a binary issue. Not so much,

LikeLike

A real eye opener. Hopefully, your provincial government will get sensible about blocking TCP before we have to turn off the taps. Everyone will suffer.

LikeLike

excellent comments Blair. Politicians always like to grandstand with simple answers to complex issues, and typically ignore the economics fundamental to any market decision. I always enjoy your columns Blair, keep up with the pragmatism.

LikeLike

Two edged commentary-a valid method to reduce portable fuel prices but also a method for the

environmental mindset to squeeze fuel consumption. This article should be required reading for our current government on how best to not start a range war with Alberta that BC can and will lose!

LikeLike

Interesting conclusion, “To conclude we, in the Lower Mainland, are buyers in a sellers market. We have no ability to dictate to the market…”. Alberta is in a reverse situation where we are the seller of our heavy crude in a buyers market. Perhaps we should work together to remedy the situation.

LikeLike

Great piece of work. Thank you for the work on this, and how clearly the concepts are presented.

LikeLike

This is seriously an awesome piece. Rarely do you go from feeling like a moron to a genius over the course of reading for 10 minutes. And running into Lawson here is pretty bizarre. Go Royals

LikeLike

Excellent article. A obvious solution to the supply dilemma would be to expand the TransMountain Pipeline allowing for more deliveries of both gasoline and crude oil for export. Kind of a win-win, wouldn’t you say?

LikeLike

That’s assuming that it would be regulated in a way to be favourable to those ends. That would mean that politicians would have to favour local over international markets and corporations. The center and right are never going to do that. They are hard core “free market” corporatists. If you want a government that actually cares about voters interests you will have to vote left.

LikeLike

Notley (was) and Horgan (is) NDP Provincial Premiers and made a mess of this issue. How far left do you have to go? Trudeau, a lefty in centrist costume, on the urging of his brain, Gerald Butts, cancelled the NEB-approved Enbridge-proposed Northern Gateway pipeline and politically interfered with the NEB to add totally inappropriate criteria and didn’t make a case to Quebec for Energy East, do displace foreign imported oil from Quebec and Atlantic Canada. Trudeau’s Bill C-48 banning tanker loading from the Northern B.C. coast would block the First Nations-sponsored Northern Spirit pipeline, leaving the Trans Mountain P/L expansion the only project ‘left standing;’ however, no prudent investors would fund it with foreign-funded activists and the B.C. NDP & Greens trying to block it, even after the Trudeau Cabinet had judged it was in Canada’s best interests. The Trudeau/Morneau team had to buy it for $4.5 +/- Billion, to try and salvage the mess Trudeau and Butts had created. We taxpayers are left footing the bill for the left-wing miss-management. That’s not in this voter’s interest, although getting fair value for Canada’s resources (and displacing foreign oil) is.

LikeLike

Awesome read. One question though. Has BC always lacked refineries? Why?

LikeLike

We had refineries in the 1960s- 1990s but land use decisions made it impossible for them to expand (which was necessary for them to survive) so most simply closed down.

LikeLike

B.C. environmental laws make building new refineries in province totally too costly to meet the billions of dollars required to make them financially stable.

LikeLike

One of the most disappointing and disheartening assaults on Alberta and the future of this Confederation, is our failure to endorse Energy East, courtesy, no doubt, of the intransigence of our “fellow” Canadians in Quebec. Their unconscionable preference for non Canadian oil is, I suspect, driven by Quebec’s apparent need to preserve certain corporate connections with the Middle East, preserve longshoreman jobs, and possibly (primarily) to sow greater interprovincial discord. This pursuit is, of course underwritten by a hapless and desperate federal Liberal party, whose only interest, and at any cost, remains the preservation of Quebec federal votes. Is there any similar strategy available to “reality test” the Quebec electorate? Sadly, I suspect not….which of course leaves among other possibilities a strategy of paying our transfer payments to Quebec not in Canadian dollars……… but in “Alberta oil equivalents”!

LikeLiked by 1 person

David

It is not Quebec that buys foreign oil but rather it is two Calgary based companies that own and operate the refineries in Quebec. Suncor has a huge tower and its corporate head office in downtown Calgary. Ultramar has its corporate headquarters at 333 – 96th Ave NE Calgary

And if you follow my postings you will find I am incredibly hard on Quebec

LikeLike

I would suggest that Suncor (not sure about Ultramar) would gladly buy Canadian/Alberta oil for their eastern based refineries if they could actually get it there.

LikeLiked by 1 person

Ultramar is 100% foreign owned, not that makes any difference. The Trudeau Liberals and their former Liberal Cabinet Minister, Denis Coderre, the loser former Montreal mayor, blocked Energy East to the detriment of the rest of Canada.

LikeLike

Does BC have any control over heavy oil export? ie. could we control the amount of heavy product in the pipeline so that {hopefully} AB would, to keep it in full operation, use it to ship finished products?

LikeLike

The B.C. Court of Appeal 5 Judge Panel (normally only 3) unanimously ruled today that the B.C government can’t meddle with or legislate what’s in the Trans Mountain (or any other) inter-provincial pipeline, YEA!

LikeLike

Great read Blair.

Where do we get our ethanol from and do other provinces have similar fuel content requirements?

LikeLike

Pingback: How Alberta could legally squeeze B.C: A Langley chemist’s roadmap to pipeline cooperation – TheChristians.com Web Journal

Jason Kenny said that somehow in the near future he would get the pipe line built. It would do good for the BC NDP government to open their eyes and see the kind of trouble they would be in if Jason follows through with his threat. You could be paying $2.00 plus to fill up your tank.

LikeLike

Heavy crude by rail.is not a good option for many reasons, should not even be on the table as an option.

LikeLike

And folks, don’t forget, this is a +50 year old pipeline. The TMX expansion, that is getting so much attention, was to replace and upgrade a deteriorating line. When the pressure required (due to increased viscosity of heavy oil) causes a break, the responsibility will fall directly on the shoulders of the protesters, and special interest groups that have stalled this process. Things get old, and when that line goes down for a spill, probably in the BC ecosystem, those in the SW of BC can sit at home because $2.00/L gas will be an ancient memory and something they hope for.

LikeLike

Tom: I agree with you with regard to the TMX springing a leak with the resulting cost of fuel going thru the roof. My biggest fear is that the BC government will then confiscate all the electric cars in BC for their own use. If that happens then I will drive my Tesla to the US border and leave it in the States (Point Roberts, Washington) and walk the 2-3 miles home. Nuff said.

LikeLike

66 years old. It went into service in 1953. It’s so obsolete and undersized it’s not funny, and most of BC is relying on that ancient pipe. It’s dumb.

LikeLike

I’m 71. My father worked for Canadian Bechtel to build the TM pipeline! He then worked as an operator for TM until his retirement. EXPAND AND UPGRADE BEFORE THERE IS A PROBLEM,

LikeLike

For people who think that the pipeline expansion will solve this:

“A 2015 analysis from oil and gas consultant Muse Stancil, prepared on behalf of Trans Mountain for hearings before the National Energy Board, says that “refined product shipments will not increase as a result of the Trans Mountain expansion project.”

“According to Trans Mountain, however, almost all of the additional capacity from the expansion project is already spoken for, and it’s not going to B.C.

“Thirteen shippers have made long-term commitments for roughly 80 per cent of the capacity on the expanded pipeline. We expect the majority of the expansion capacity will be for export,” the pipeline company said in an email.”

LikeLike

What say you, Blair? Doesn’t expansion free up capacity on the exiting pipeline for additional refined products movement?

LikeLike

So obviously we still need Northern Gateway to ship offshore.

Can’t change governments fast enough!

LikeLike

Pingback: Another look at the Trans Mountain Pipeline Expansion Project from the lens of a pragmatic environmentalist | A Chemist in Langley

Pingback: Debunking more misinformation about the Trans Mountain Pipeline Expansion project. Some simple facts about bitumen, heavy oil, and Asian Markets. | A Chemist in Langley

Two things missing…I could not find any reference to how much crude from the TM pipeline is transported to the Washington refineries…and since the feds bought TM the amount of refined products have decreased, how come?

LikeLike

And according to the NEB, BC produces 75.5 thousand barrels a day of light oil, where is this refined since Husky and Parkland receive the bulk of their crude from outside BC?

LikeLike