Yesterday, I was directed to a new report by the Canadian Centre for Policy Alternatives (CCPA) about the Trans Mountain Expansion (TMX) project. As I have written previously, every time I get a notification about one of their reports, I hope that it will present an evidence-based analysis consistent with the quality of the individuals I know work there. Sadly, they always manage to disappoint. I could fill an entire section of my blog with examples of their disappointing reports.

This new report was written by David Hughes, one of their policy analysts I have come across before and is titled: Reassessment of Need for the Trans Mountain Pipeline Expansion Project Production forecasts, economics and environmental considerations. The report purports to “assess the latest data on the need for the TMX” but as I will show in this blog post, it does nothing of the sort. Much of the data used in the report is either woefully out-of-date or lacks the context necessary to be of any use in any evidence-based, decision-making process. Most importantly, the report obfuscates the entire point of the TMX which is to provide producers in Alberta with access to new markets for their production.

I started reading the report with open, but skeptical, eyes but it didn’t take long to recognize that I was going to need to scrutinize the document very carefully. An obvious misstatement set my fact-checker’s radar off. On page 15 the author writes:

Although rail is a more expensive option than pipelines, it has the flexibility to access markets not served by pipelines and is three times safer than pipelines in terms of the volume of oil spilled per ton-mile transported.18

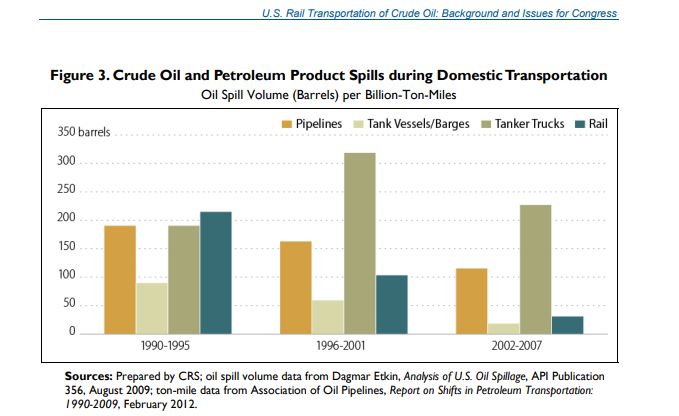

This statement ran contrary to everything I knew about this topic so I consulted the footnote. It cited a Congressional Research Service report from 2014 titled: U.S. Rail Transportation of Crude Oil: Background and Issues for Congress. The footnote indicates the statistic is from Figure 3 of this report (reproduced below):

The claim was based on the last block depicting the information from 2002-2007. The author has chosen data that pre-dates the massive spike in rail transportation of crude oil in the last decade and pre-dates significant events like Gogamas, Galenas, Lac Megantic, the dozen or so other rail issues that didn’t make our local press and the Mosier derailment that came within feet of hitting the Columbia River. It also omits the years earlier where rail was not 3 times safer. How can that be described as assessing the latest data?

As my readers know, I have written extensively on the relative risks of pipelines versus oil-by-rail. We all know that a recent report indicated that the risk of incident is 4.5 times higher for transportation via rail over pipeline. While many have challenged the precision of that statistic, there is no doubt that its analysis does not rely solely on data from the US between 2002 and 2007 while omitting everything before and after that limited time frame in Canada and the US. This dubious choice caused me to question the validity of every reference and data point used in the study. Once I started looking carefully more issues with this report started to emerge.

Consider Figure 4 that purports to present the “Existing and proposed Western Canada export takeaway capacity and domestic refinery consumption”. While it is hard to see the refining volume rises significantly. This is because

The refinery capacity in Alberta has also been increased by 79,000 barrels per day in 2025 and again in 2030, to reflect the probable addition of Phases 2 and 3, respectively, of the Sturgeon refinery.

Anyone familiar with the Sturgeon Refinery knows that it has been a financial boondoggle and that the consortium that owns the project has withdrawn their proposal to expand the refinery. Treating this capacity expansion as a given (as is done in this report) does not reflect reality.

As for the report’s analysis of markets, it is equally out-of-date. When discussing the Asian market for heavy oil it relies on data that is no longer relevant. As I discuss in my previous post “Understanding future demand for heavy oil – Why the Trans Mountain Pipeline Expansion project is a good bet for Canada” Asian refinery owners have been frantically upgrading their refineries to process heavy oil. As I discuss in that post “Asian refineries can refine over 8 times what Line 2 of the TMX can supply to Westridge Marine Terminal for export”. I provide all the most recent numbers in my previous post.

Besides providing out-of-date information for Asian refining capacity, the CCPA report has a startling omission. It completely omits the American west coast as a market for Trans Mountain oil. The report appears to imply that the TMX is solely intended to serve the Asian market. Nothing could be further from the truth. The point of the pipeline is to provide ready access to a marine port where the oil can obtain world market prices, and one of the places where that is going to happen is in California.

In case you don’t follow the US crude business there are some important things to understand. The US market is broken into Petroleum Administration for Defense Districts (PADDs) and PADD 5 (the West Coast, Alaska and Hawaii) is not interconnected to the rest of the US by pipelines. California and Alaska have historically supplied the lion’s share of the demand in PADD 5. What most don’t know is that California produces some of the highest GHG intensity fuel on the planet (even higher than oil sands crude) but that heavy oil is drying up. Alaskan oil is also drying up. This leaves much of PADD 5 with a supply shortage.

As a consequence, one of the most important markets for the TMX will be California which has a lot of heavy oil refining capacity and is losing its domestic supply of heavy oil. Currently, very little Alberta crude can get to California, but after the TMX it will more accessible. Now this is not some secret unknown to the activist community. Greenpeace recently did a big report on the topic. Yet somehow the CCPA report completely omits California from its analysis.

Another interesting omission occurs in the discussion about Maya crude (Mexico’s chemical twin to Alberta’s Western Canada Select). Maya is derived from the Cantarell and Ku Maloob Zaap oil fields in the Gulf of Mexico. The nautical distance between the Port of Vera Cruz in Mexico to Shanghai China is almost 10,020 nautical miles. The two ports are almost as far apart as you can put two ports. This incredible distance results in high transportation costs. On the other hand, these Mexican ports are essentially next door to the US Gulf Coast refineries. So it isn’t a big surprise that Maya sells for a higher price for use in the Gulf Coast than it does for use in Asia. That would explain why today (October 30th, 2020 from OilPrice.com) Maya is selling for $38.41/barrel in the Gulf Coast while it is selling for $35.42/barrel to Asia. Western Canada Select, meanwhile, is selling for $26.57/barrel. Given that the two are chemical twins that difference of over $10/barrel is primarily due to Maya having access to a marine port.

Going back to the West Coast, the nautical distance from the Port of Vancouver to Shanghai is 5110 nautical miles. By halving the distance the price to transport the oil goes down and the price Albertan producers can get for it goes up. Remember earlier when I talked about all that crude going to California. The trip from Vancouver to San Francisco is only 812 nautical miles and the cost to ship a barrel of oil from Vancouver to San Francisco is only $4/barrel. Given that short trip (and low transportation costs) the Californians can outbid the Chinese for Alberta oil because their shipping costs are so much lower.

Now everything above is important but the real trick in this report is misdirection. The author spends almost half his text talking about how it may eventually be possible to transport all Alberta’s production, using rail and new pipelines, to the US mid-west. Thus, arguing that the TMX is unnecessary. But that ignores the entire point of the TMX. The TMX is intended to get Canada out of the current situation where Alberta can only sell its oil to one market and thus has no ability to shop its oil around to get the best price possible.

The author is correct that Alberta may well have lots of transportation capacity to PADD Regions 2, 3 and 4, in the future, but in doing so it highlights that Albertan producers do not have ready access to PADD Region 5 or the rest of the world for that matter. The entire purpose of the TMX is to address that critical bottleneck blocking Albertan access to the world oil markets where Albertan producers can get market prices for their production.

It is really hard to know what to say at this point. I have only scratched the surface on this report and already I have determined that it is not a useful resource for environmental decision-making. As I detail above, the report

- relies on out-of-date data for heavy oil refining capacity in Asia,

- assumes that the cancelled expansion of the Sturgeon refinery will pull away capacity from the TMX,

- ignores the emerging California market for heavy oil,

- relies on questionable data to discuss the risks of oil-by-rail,

- omits the transportation costs of Maya to Asia, and

- obfuscates the entire point of the TMX which is to provide producers in Alberta with access to new markets for their production.

As usual you hit the nail on the head.

The Canadian Center for P.A. Is a union , green backed organization.No one ever would call these guys objective.

They need to be exposed and you have succeeded.

LikeLiked by 1 person

The “study” you criticized was not intended to be accurate. It was intended to appeal to the usual donors to that organization. I’m grateful, however, that you took the time and trouble to point out where it was wrong.

LikeLiked by 1 person

So let me get this straight …..China is going to buy Alberta oil because of a pipeline expansion? A pipeline that has existed for what 50 , 60 years. How many tankers have left Vancouver to China? How many tankers of Alberta oil have left Texas for china 5, 6 ? This is what your basing your argument on? China is transforming it`s refineries? To buy Alberta oil? really ? They aren`t buying oil from Iran, Iraq. Nigeria? Why do the Chinese buy from Nigeria ? It`s CHEAPER ! California? Vancouver sent about 20 tankers to California . These are the foreign markets your talking about? The distance from China ? Why does Alberta oil leave from Texas? That`s where the refinery is ! This is just absolute NONSENSE . Just another right wing nutbar grasping at straws. I`m starting to think Albertans deserve everything they get !!

LikeLike

You are simply repeating information I have previously discussed in depth. https://achemistinlangley.net/2020/09/22/understanding-future-demand-for-heavy-oil-why-the-trans-mountain-pipeline-expansion-project-is-a-good-bet-for-canada/ The Chinese have been importing Alberta oil from Texas they are desperate for the stuff.

LikeLiked by 1 person

I have also look at many policies from many angles – https://www.slideshare.net/paulyoungcga/key-macro-and-micro-indicators-canada-and-usa-august-2020-and-september-2020

LikeLike

Another brilliant piece …keep up the good work!

LikeLiked by 1 person

Glen S.

The problem is that Alberta is not getting all they deserve! Fair prices for their products. Remember the CROW rate for grain! How anout that for fair shipping arrangements that the farmer in Alberta got for years. Yes man years. Give the West what it deserves and stop taking all that is available. Through all this the Alberta oil play has paid a heavy price to this country through equalization.

LikeLiked by 1 person

We have the product, we have the capacity we have we knowledge on what has to be done but we have a prime minister that rather take selfies than get the Canadian economy on the right track.The demand is there all we need is politicians to work together and make it happen.

LikeLike

Pingback: Another Day, Another Flawed CCPA Report, This Time About the Trans Mountain Expansion Project – HoweStreet

Pingback: Evaluating what the new Canadian Energy Regulator report actually says about the viability of the Trans Mountain Pipeline | A Chemist in Langley

We’ve got to get off oil or we’re all headed towards ecological collapse. Climate change is real.

LikeLike

Pingback: Reviewing Seth Klein’s A Good War – An interesting historical review that ignores the details of climate science | A Chemist in Langley